Advait Energy Transitions Ltd (AETL): A Rare Cross-Sector Compounder in the Making

Powering India’s grid through live-line reconductoring & EPC. Now pivoting to clean tech with electrolyzers, BESS & solar.

Powering India’s Grid. Building India’s Green Future.

Investment Thesis:

AETL is a rare infra-to-energy transition play — combining deep execution credibility in power infrastructure with fast-emerging clean-tech verticals like BESS, hydrogen, and solar. With high return ratios, vertical control, and an ₹800 Cr order book, it offers a compelling multi-year compounding setup.

Infra Muscle + Energy Vision = Unique Play

Founded in 2010, AETL began as a specialized EPC and stringing tools provider for India’s power grid.

Now transforming into a clean-tech solutions provider with verticals in:

Solar EPC

Battery Energy Storage (BESS)

Green Hydrogen (GH2)

Global presence: 45+ countries

450+ projects delivered

FY25 Financial Snapshot:

Revenue: ₹399 Cr

ROCE: 28%

Order Book: ₹800 Cr

Rare convergence of infra execution depth and clean energy ambition.

Power Transmission: Execution Moat with Proven Muscle

50% market share in stringing tools

30% share in insulators

18,000+ km live-line stringing executed

8,000 km OPGW annual capacity

First to supply Make-in-India ERS (Emergency Restoration System) to PGCIL

FY25 Infra Revenue: ₹295 Cr

Strong infra credentials → trust with utilities → 2x revenue visibility

From Optionality to Core Growth: Clean-Tech Now >25% of Revenue

What started as an "optionality" is now turning into AETL's second growth engine:

Solar EPC: ₹96.1 Cr revenue in FY25 | 250+ MW/year execution

Battery Storage: 50 MW / 100 MWh project for GUVNL underway

Green Hydrogen: ₹5.8 Cr EPC project booked

Electrolyzer Capex: ₹75 Cr for 300 MW capacity under India’s PLI

Fuel Cell JV with AVL (Austria) and TECO (Norway)

Clean-Tech now >25% of revenue, with policy tailwinds accelerating growth.

Subsidiaries: Full-Stack Clean-Tech Ecosystem in Motion

AETL is building a rare vertical clean-tech moat through its subsidiaries:

Control across EPC, electrolyzers, fuel cells, and BESS = clean-tech integration moat

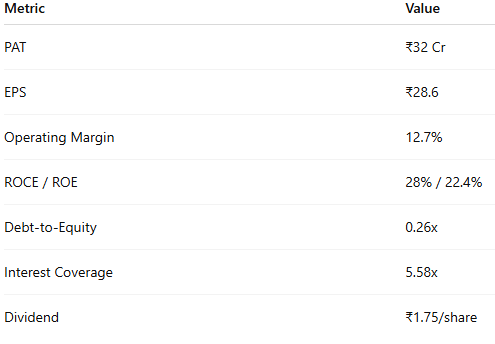

FY25 Financials: High-Quality, Asset-Light Growth

High returns, low leverage, consistent profitability — with minimal capital intensity.

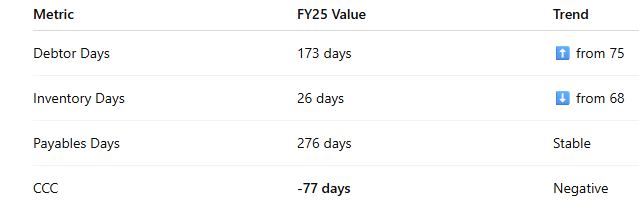

Working Capital: Structurally Efficient, But Debtors Need Watching

While CCC remains negative, Debtor Days have more than doubled a key watchlist item for FY26.

₹800 Cr Order Book = Strong Revenue Visibility

As of May 2025, major projects include

₹86 Cr OP GW order from PGCIL

100 MW Solar EPC for Adani Green (Khavda)

50 MW / 100 MWh BESS for GUVNL

2x revenue visibility heading into FY26, with clean-tech forming a bigger share.

Peer Comparison

AETL may be smaller in size but cleaner in capital structure, more integrated in clean-tech, and higher in return ratios.

Key Risks & Monitorables

Debtor Days spiked 2.3x YoY—collections need watching

Execution timelines in new verticals (GH2/BESS) untested

Policy dependency—PLI schemes critical for electrolyzers/hydrogen

Heavy dependence on PSU clients (PGCIL, GUVNL, etc.)

Your support helps keep this research independent. If you’d like to contribute, feel free to donate; any amount helps.

Final Word: Why AETL Is a Rare Compounder

Dual-engine growth: Infra + Clean-Tech

Execution moat across 450+ completed projects

Clean tech is now >25% of revenue and rising

Vertical control via subsidiaries (EPC, fuel cells, BESS, etc.)

High ROCE, negative CCC, low leverage

₹800 Cr order book ensures revenue visibility

Advait Energy Transitions Ltd is no longer just an EPC player.

It’s steadily positioning itself as a critical enabler of India’s energy transition one that’s lean, proven, and increasingly clean.

Enjoyed this deep dive? Tap the like to boost discovery!

Comments are open below. Share your take or challenge ours.

Follow us on X & LinkedIn

Join Finance Fusion for exclusive insights & stock discussions.

Suggest to add a section on Valuation- is it a buy at the current price considering the revenue growth or it is already priced in

Sure