🏗️ Building India's Water Future: Electrosteel Castings Ltd

BSE: 500128 | NSE: ELECTCAST | Market Cap: ₹5,500 Cr | Sector: Water Infrastructure & Pipe Manufacturing

1. What Does the Company Do?

Electrosteel Castings Ltd. is India’s largest manufacturer of ductile iron (DI) pipes and fittings, catering to water supply, sewerage, and irrigation projects.

Key operations:

Manufacturing DI pipes, DI fittings, CI pipes, and restrained-joint pipes.

Integrated production of sponge iron, ferro alloys, metallurgical coke, and cement (by-products of steelmaking).

Exporting pipes to 90+ countries worldwide (Middle East, Africa, Southeast Asia, Europe).

It operates through five state-of-the-art plants across West Bengal, Andhra Pradesh, and Odisha.

2. Main Sources of Revenue & Margins

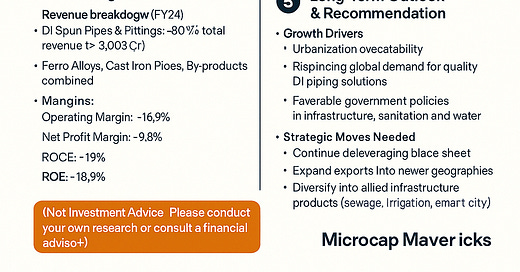

Revenue Breakdown (FY24):

DI Spun Pipes & Fittings:

80% of total revenue (₹5,632 Cr)Ferro Alloys, Cast Iron Pipes, By-products: ~20% combined

Margins:

Operating Margin: ~16.9%

Net Profit Margin: ~9.8%

ROCE: ~19%

ROE: ~19.3%

Note: FY24 net profit doubled (+120% YoY), driven by higher volumes and operating leverage.

3. What Excites You About This Business?

✅ Massive Infrastructure Opportunity:

Programs like Jal Jeevan Mission (₹3.6 lakh Cr) and AMRUT 2.0 (₹2.99 lakh Cr) are driving huge demand for water pipes across India.

✅ Global Export Footprint:

Exports contribute ~18% of revenues despite global headwinds. Electrosteel supplies DI pipes to 90+ countries.

✅ Capacity Expansion:

New plant projects in Odisha and production upgrades at existing plants to tap rising domestic and export demand.

✅ Operational Efficiency Gains:

Higher EBITDA margins and declining debt improve financial resilience.

✅ Brand Recognition:

International certifications and decades of experience give Electrosteel an edge in winning mega water projects.

4. Key Risks

⚠️ Raw Material Price Volatility:

Steel, iron ore, and coal price fluctuations can compress margins.

⚠️ Competitive Pressure:

Rising competition from domestic DI pipe makers and alternatives like PVC pipes.

⚠️ Export Headwinds:

EU trade barriers (like the CBAM carbon tax) could impact overseas profitability.

⚠️ Infrastructure Spend Dependency:

Heavy reliance on sustained government infrastructure projects (e.g., if Jal Jeevan funding slows).

⚠️ Moderate Debt Levels:

Net debt of ₹1,764 Cr exists (gearing ~0.26x); it needs monitoring despite improving.

5. Long-Term Outlook & Recommendation

Growth Drivers:

Urbanization and water supply modernization in India.

Expanding global demand for quality DI piping solutions.

Favorable government policies in infrastructure, sanitation, and water sectors.

Strategic Moves Needed:

Continue deleveraging the balance sheet.

Expand exports into newer geographies.

Diversify into allied infrastructure products (sewage, irrigation, smart city projects).

Valuation:

P/E ~8.2x FY24 earnings — attractive given ~19% ROCE and strong earnings growth.

Price/Book ~1.15x — reasonable for an infra-linked manufacturing leader.

Catalysts to Watch:

New project awards under Jal Jeevan Mission & AMRUT 2.0.

Completion and commissioning of new Odisha plant.

Softening raw material costs improves margins.

Positioning:

A high-quality infrastructure manufacturing play benefiting from India's $1.4 trillion national infrastructure pipeline — offering value + growth for long-term portfolios.

(Not Investment Advice.). Please conduct your own research or consult a financial advisor.)

Management is not ethical, so beware of this company

Aggred✅✅