Indian Cement Sector Analysis

Structural Consolidation Meets Long Term Compounding

Investment Summary

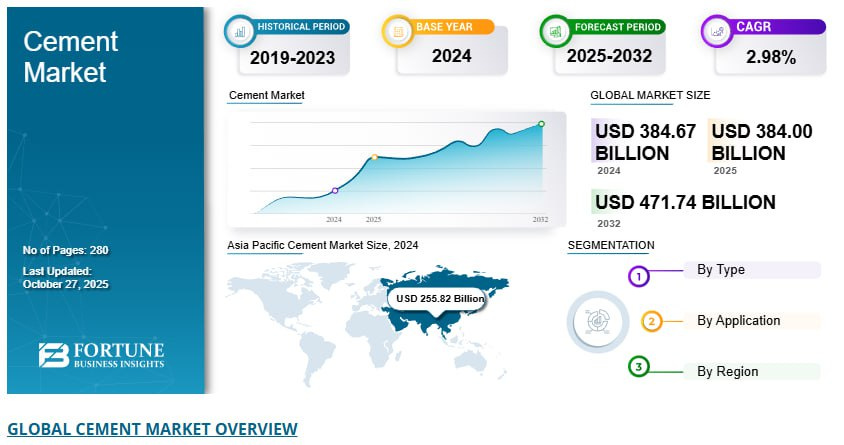

The Indian cement industry is undergoing a decisive structural shift. A historically fragmented, regionally competitive commodity business is steadily consolidating into an oligopolistic market dominated by a few national scale players. This transition is supported by sustained infrastructure demand, rising urbanisation, sustainability driven cost efficiencies, and aggressive mergers and acquisitions.

Simultaneously, several small and mid sized listed cement companies continue to trade well below replacement cost. This creates a powerful asymmetry between asset value and market valuation. The combination of consolidation and long term demand visibility makes cement one of the most attractive sectoral opportunities within India’s physical economy.

Industry Structure and Installed Capacity

• India’s total installed cement capacity stands at 663 MTPA as of March 2025

Regional capacity distribution

• South India 221 MTPA or 33%

• East India 135 MTPA or 20%

• North India 127 MTPA or 19%

• West and Central India 14% each

Rising industry concentration

• Top 5 producers control 398 MTPA or 60% market share

• Top 10 producers control 505 MTPA or 76% market share

• UltraTech Cement has crossed 157 MTPA

• Adani cement platform including Ambuja, ACC, Sanghi, Penna and Orient exceeds 100 MTPA

This scale concentration is structurally improving pricing discipline and return profiles.

Cement Demand, Production and Utilisation

• Cement production increased from 261 MT in FY15 to 453 MT in FY25

• Cement consumption reached 445 MT in FY24

Demand growth outlook

• FY24 growth 8 to 9%

• FY25–FY26 expected moderation to 5 to 6.5%

• Pan India capacity utilisation remains sub optimal at 65 to 69%

• Under utilisation encourages consolidation rather than greenfield expansion

Exports remain limited and stable, while imports are negligible, reinforcing India’s self reliant cement ecosystem.

Manufacturing Process and Entry Barriers

Cement manufacturing involves limestone mining, crushing, blending, raw grinding, preheating, clinkerisation at 1450°C, clinker cooling, cement grinding, storage, and dispatch.

Key structural entry barriers

• Secured limestone reserves

• High capital intensity

• Energy efficiency

• Logistics proximity to markets

Indian cement companies are among the most energy efficient globally with thermal energy consumption near 725 kcal per kg of clinker and electrical consumption around 75 kWh per tonne. This efficiency advantage supports both margins and sustainability goals.

Shift Toward Blended Cement

• Blended cement now accounts for 75% of total production

• Ordinary Portland Cement share has declined to 20-25%

This shift reduces clinker intensity, lowers costs, improves sustainability, and supports long term margin stability. Composite and specialty cements are increasingly used in infrastructure and urban construction.

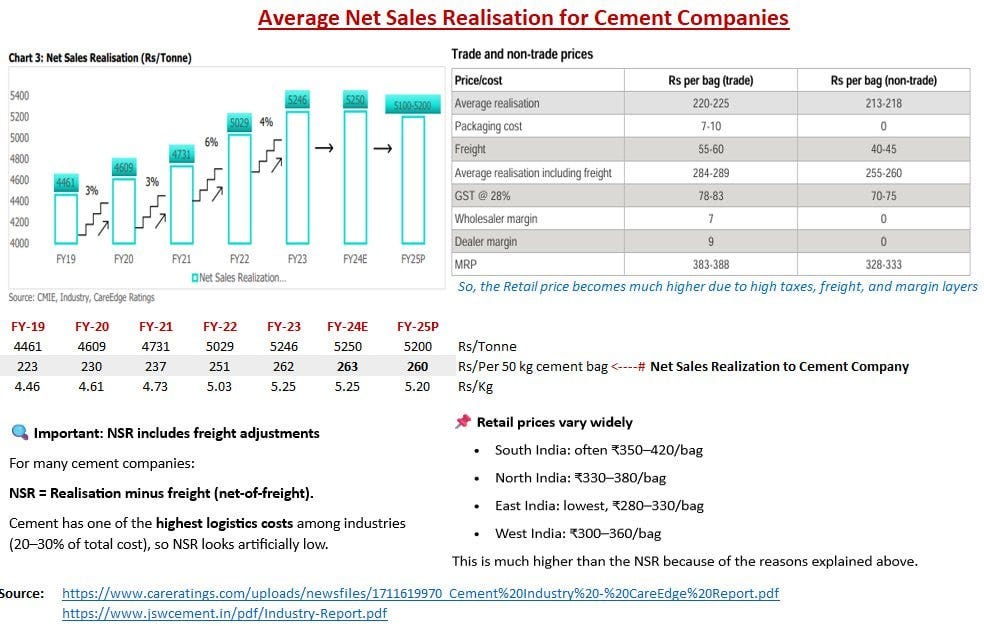

Pricing and Realisation Dynamics

Retail cement prices

• FY18 ₹334 per bag

• FY23 ₹391 per bag

• FY24 ₹384 per bag

• FY25 expected ₹373-378 per bag

• Net sales realisation to companies is significantly lower due to freight, taxes, and dealer margins

• NSR improved from ₹4,461 per tonne in FY19 to ₹5,200 per tonne in FY24–FY25

Cost structure insights

• Logistics accounts for 20-30% of total cost

• Regional dominance is more important than pan India branding

South India commands the highest prices, East remains the most competitive, while North and West fall in between.

Profitability and Margin Trends

• EBITDA margins compressed in FY23 due to energy inflation

• Margins recovered meaningfully in FY24

Current profitability

• Industry average EBITDA margin 15-16%

• Efficient players above 18%

• EBITDA per tonne ₹880-₹940 for strong operators

This highlights the operating leverage inherent in cement once costs stabilise and pricing discipline holds.

Consolidation and M&A Wave

Major transactions over the last decade include

• UltraTech acquiring Jaypee, Binani, Century Cement, Kesoram and India Cements

• Adani Group acquiring Ambuja, ACC, Sanghi, Penna and Orient

• Nuvoco entering via Lafarge India and Emami Cement

• Dalmia Bharat acquiring Jaypee assets

• Over 200 MTPA of capacity consolidated in the last 10 years

• Acquiring capacity is cheaper and faster than greenfield expansion

• Limestone and land remain the true strategic assets

Replacement Cost and Small Cap Opportunity

• Replacement cost of cement plants continues to rise due to capital, approvals, and gestation periods

• Several listed small and mid sized cement companies trade at 0.4- 0.5x replacement cost

These companies often possess valuable limestone, land, and operating assets, creating embedded optionality through consolidation or cyclical recovery.

Long Term Investment View

Cement is not a short term trading story. It is a long duration play on India’s physical growth.

• Large players offer stability, pricing power, and balance sheet strength

• Smaller players offer asymmetric upside through consolidation and re rating

Over the next decade, returns will accrue to investors who focus on

• Scale and regional dominance

• Cost efficiency and logistics control

• Balance sheet discipline

• Asset value relative to market capitalisation

Key Risks

• Energy and fuel price volatility

• Regional overcapacity

• Regulatory delays in mining leases

• Aggressive capacity addition without matching demand

These are cyclical risks rather than structural threats.

Analyst Conclusion

The Indian cement sector is transitioning from fragmentation to consolidation, from volume chasing to return discipline, and from commodity pricing to regional oligopolies.

For long term investors, cement offers a rare convergence of infrastructure demand, consolidation economics, and replacement cost asymmetry.

Patience, not prediction, will drive returns.

Why get Alpha Access?

Because you get high-conviction, deeply-researched multibagger picks before the crowd. We focus on undiscovered microcaps, early growth trends, insider-level sector insights, and clear entry/exit strategies giving you an edge that regular market research simply doesn’t offer.

© 2025 Microcap Mavericks ∙ Finance Fusion

Privacy ∙ Terms ∙ Collection Notice