Trishakti Industries Ltd – Lifting India’s Infrastructure Growth

A debt-light infrastructure enabler quietly compounding through India’s ₹800B capex wave

Company Overview

Founded in 1985 and headquartered in Kolkata, Trishakti Industries Ltd has evolved from supplying ONGC/OIL drilling equipment into one of India’s leading heavy equipment leasing and infra-support providers. The company’s asset base includes a diverse fleet of crawler cranes, piling rigs, and boom lifters serving over 100 clients across 20+ industries.

Trishakti operates with 100% fleet utilization, minimal debt, and internally funded expansion a strong indicator of operational efficiency and capital discipline.

Business Model

Trishakti follows an equipment leasing model that earns recurring, high-margin rental income by hiring heavy earth-moving and lifting machinery for long-duration infrastructure projects.

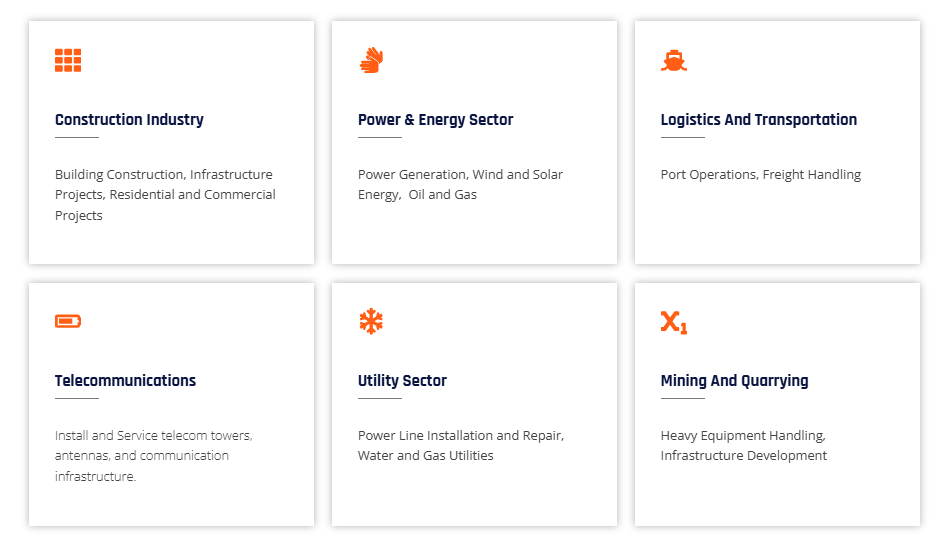

Its operations span:

Steel

Power

Railways

Construction

Ports

Renewables

Telecom

The company has gradually shifted from oil & gas drilling support to infrastructure-centric leasing, aligning itself with India’s multi-year capex boom.

Investment Rationale

Positioned for infrastructure and renewable energy growth

Recurring, high-margin revenue with ROCE of 20–25% on new capex

Diversified industry mix reduces cyclicality risk

Tier-1 clientele: L&T, Tata, Reliance, Adani, ONGC, Jindal, KEC

Beneficiary of India’s ₹800-billion government infra push

Strong base to scale operations and capture renewable & metro expansion demand

Outlook & Growth Drivers

India’s equipment rental industry projected to grow 16–18% CAGR till 2030

Increasing asset-light preference among EPC players driving leasing demand

Government infrastructure allocation: $800 billion over 5 years

Target revenue: ₹900–1,000 million by FY28

Margin outlook: 60–65%

Growth focus on renewables, railways, and metro projects

Sectoral Opportunity

Fleet presence across Steel, Power, Metro, Ports, Renewables, and Chemicals

India’s Renewable Energy capex: ₹25–30 lakh crore by 2030

→ translates to ₹11,000–17,000 crore crane-rental potentialKey clients (L&T, Tata, KEC, NCC) engaged in ₹6.95 lakh crore of renewable projects

Expected continued surge in high-capacity crane utilization over the next decade

Competitive Strengths

Diversified Fleet Advantage – One of India’s widest portfolios of cranes and piling rigs (45–750 MT), enabling flexibility across project types.

Blue-Chip Client Base – Long-standing contracts with L&T, Tata, Adani, ONGC ensure revenue stability and low churn.

High Utilization & Recurring Cashflows – 100% fleet deployment across ongoing infra projects ensures consistent earnings visibility.

Debt-Light Balance Sheet – Expansion funded through internal accruals, improving return ratios and financial resilience.

Sectoral Hedge – Exposure across steel, renewables, and ports minimizes cyclical downturn risk.

Operational Expertise – Four decades of on-ground experience in project logistics, safety, and large-scale equipment deployment.

Strong ROCE Profile – Sustained 20–25% ROCE on capex makes Trishakti among the most efficient equipment lessors in India.

Financial Highlights (Q2 FY26)

Revenue: ₹668.78 lakh (+63% QoQ | +213% YoY)

EBITDA: ₹392.16 lakh (+45% QoQ | +374% YoY)

EBITDA Margin: 58.97%

ARR: ₹360 million post H1 FY26

Full fleet utilization; temporary margin dip due to project delay

Capex & Expansion

Planned ₹400 crore capex (FY25–FY27)

₹16 crore spent FY25

₹84 crore invested H1 FY26

Investing in high-capacity cranes to meet demand from metro & renewable corridors

Expected ROCE: 22–25%

Funded via internal cash flows, ensuring debt discipline

Recent Key Orders (FY25)

Jindal Ferrous: ₹27 Mn | Blast Furnace Project

Jindal Stainless: ₹20 Mn | SMS & Blast Furnace Project

KEC International: ₹45 Mn | Tata Steel Ludhiana Plant

ITD Cementation: ₹20 Mn | Chennai Metro Phase 2

Clientele & Sectors

Major Clients: Tata, L&T, Reliance, Adani, ONGC, Jindal Steel & Power, KEC

Industries Served: Steel | Power | Construction | Railways | Ports | Renewables | Telecom

Product Portfolio

Crawler Cranes: 45–750 MT

Truck Mounted Cranes: 45–750 MT

All Terrain Cranes: 250–750 MT

Piling Rigs: 185–285 kNm

Manlifters/Boomlifters: 60–220 ft

Analyst Take

Trishakti represents a picks-and-shovels play on India’s ongoing capex boom earning stable, high-margin cashflows without taking direct project or execution risk. The firm’s strong utilization, recurring order base, and debt-light balance sheet position it favorably versus peers like Action Construction and Sanghvi Movers.

With consistent margin expansion, planned capex, and expanding renewable exposure, Trishakti could compound earnings at 25–30% CAGR over FY25–FY30.

Valuation re-rating potential remains significant once scale and institutional coverage improve.

In our view, Trishakti is a steady multi-year infra compounder riding India’s $800-billion investment wave not flashy, but dependable.

Risks

Project delays or payment lags from EPC clients

Maintenance costs for aging fleet

Infra-spending slowdown impacting deployment

Receivable cycle pressure from government-linked projects

Disclosure

This analysis is for educational purposes only and not investment advice. Please conduct your own research before investing.

Why get Alpha Access?

Because you get high-conviction, deeply-researched multibagger picks before the crowd. We focus on undiscovered microcaps, early growth trends, insider-level sector insights, and clear entry/exit strategies giving you an edge that regular market research simply doesn’t offer.

© 2025 Microcap Mavericks ∙ Finance Fusion

Privacy ∙ Terms ∙ Collection Notice

Debt to equity ratio high

Impressive breakdown. The 100% fleet utilization combined with 58% margins shows this isnt just abusiness model its operational mastery in a capital-heavy industry. The shift from oil & gas to diversified infra (steel, metro, renewables) is smart risk hedging, especially as EPC players increasingly prefer asset-light models. That 22-25% ROCE on new capex is what separates serious compounders from equipment owners.